99 Exchange KYC Verification: Complete Verification Guide

The online iGaming industry is growing at a rapid pace, and with this growth comes the responsibility of ensuring user security and legal compliance. One of the most important requirements for using any trusted iGaming platform is KYC verification. This 99 Exchange KYC Verification: Complete Verification Guide will help users understand the entire verification process in a simple and structured way.

KYC stands for Know Your Customer. It is a process used by online platforms to confirm that users are genuine and legally allowed to use their services. On the 99 Exchange platform, KYC is mandatory for withdrawals and for accessing full account features. Without completing this process, users may face limitations that can affect their gaming experience.

Table of Contents

Understanding 99 Exchange KYC Verification

The purpose of 99 Exchange KYC Verification is to verify the identity of every registered user. This process helps prevent fraud, fake accounts, and illegal financial activities such as money laundering. It also protects genuine users by ensuring that their funds and personal information remain safe.

KYC verification mainly confirms three important things: identity, address, and sometimes banking information. Once verified, users can withdraw money without restrictions and access all features of the platform. This creates trust between users and the platform and promotes responsible gaming.

KYC is not just a security step but also a legal requirement. Many online gaming platforms must follow strict regulations, and KYC ensures compliance with these rules. This makes 99 Exchange a safer and more reliable platform for users.

Why KYC is Mandatory on 99 Exchange

Many users wonder why they cannot withdraw money without completing KYC. The reason is that 99 Exchange must comply with legal and financial regulations. These rules help protect both the platform and its users from misuse and fraud.

KYC ensures that only genuine users are playing on the platform. It prevents underage gaming and stops people from creating multiple fake accounts to misuse bonuses or promotions. From a user’s perspective, KYC brings confidence that their account is protected and their winnings can be withdrawn securely.

Some important reasons why KYC is mandatory include:

- Protection against fraud and fake accounts

- Compliance with legal and regulatory standards

- Secure withdrawal and deposit system

- Increased trust and transparency

These reasons make KYC a critical step for every user on 99 Exchange.

Documents Required for 99 Exchange KYC Verification

To complete the 99 Exchange KYC Verification: Complete Verification Guide, users must submit valid and clear documents. These documents are only used for verification purposes and are stored securely.

Identity proof documents may include Aadhaar Card, PAN Card, Passport, or Voter ID. Address proof can be a utility bill, bank statement, or Aadhaar Card with address details. In some cases, users may also be required to submit bank verification documents such as a cancelled cheque or the first page of their passbook.

It is very important that all documents are readable and not expired. Blurry or cropped images are one of the most common reasons for KYC rejection. Users should always upload original photos instead of screenshots or edited images.

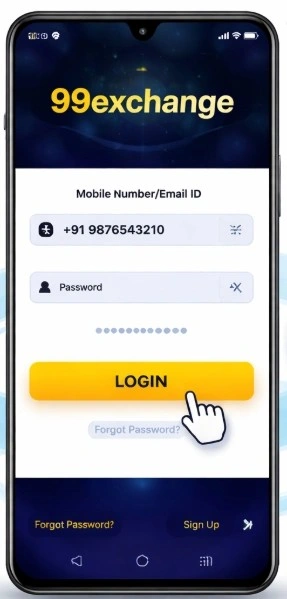

Step 1: Login to Your 99 Exchange Account

The first step in the KYC process is logging in to your 99 Exchange account using your registered mobile number or email ID. Once logged in, go to your profile section or dashboard where the KYC verification option is available.

This section is usually clearly marked as “KYC Verification” or “Verify Account.” Clicking on this option will take you to the verification form where you need to enter your details and upload documents.

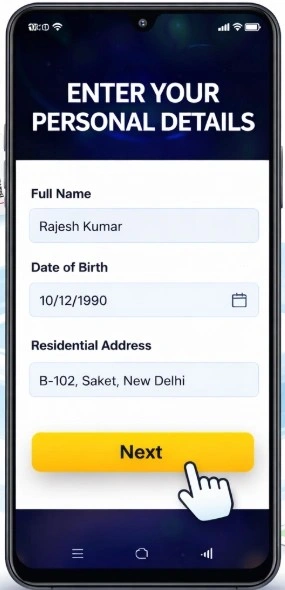

Step 2: Enter Your Personal Details

In this step, you must fill in your personal information such as your full name, date of birth, and residential address. These details must exactly match the information printed on your identity documents.

Even small spelling mistakes or differences can lead to rejection. For example, if your name on the account does not match your PAN Card or Aadhaar Card, your KYC may fail. Always double-check your information before moving to the next step.

Step 3: Upload Required Documents

After entering your personal details, the next step is to upload your documents. You will be asked to upload images of your identity proof and address proof.

Make sure that the photos are taken in good lighting and that all text is clearly visible. Avoid using filters or editing tools on the images. Cropped or blurred photos may result in rejection.

This step is very important because document quality directly affects approval time.

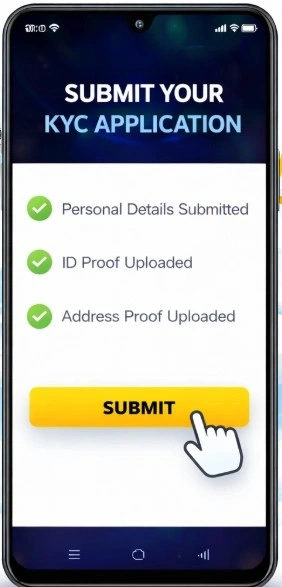

Step 4: Submit Your KYC Application

Once you have uploaded your documents and checked your personal details, you can submit your KYC application. After submission, your documents will be reviewed by the verification team.

The verification process usually takes between 24 to 48 hours. During this time, you should avoid making changes to your profile or uploading new documents unless requested.

When your KYC is approved, you will receive a confirmation message, and your account will become fully verified.

Common Problems During KYC Verification

Even though the process is simple, many users face problems during KYC verification due to small mistakes. These mistakes can delay approval and cause frustration.

Some common reasons for KYC rejection include:

- Uploading blurred or unclear document images

- Name mismatch between account details and ID proof

- Submitting expired or invalid documents

- Uploading screenshots instead of original photos

These issues can be easily avoided by carefully following instructions and checking documents before submission.

Tips for Faster KYC Approval

To get your KYC approved quickly, it is important to follow best practices. Always use a good-quality camera and take photos in a well-lit area. Ensure that all details on the document are clearly visible.

Your personal details should exactly match your ID proof. Avoid using short forms or nicknames. Do not edit or compress images, as this can reduce clarity and lead to rejection.

For better results, remember these tips:

- Upload clear and original document images

- Match your personal details with your ID proof

- Avoid screenshots and edited images

- Recheck all information before submission

These steps will help you complete your KYC smoothly and without delays.

Security and Privacy on 99 Exchange

Many users worry about the safety of their personal data during KYC. 99 Exchange uses advanced encryption technology to protect user information. All documents submitted for verification are stored in secure systems and are only used for identity confirmation.

The platform follows strict privacy policies and does not share user data with unauthorized third parties. This ensures that your personal and financial information remains confidential and protected at all times.

KYC plays an important role in building a secure gaming environment where users can trust the platform with their data and money.

Benefits of Completing 99 Exchange KYC Verification

Completing KYC gives users full access to the platform. Withdrawals become faster and smoother, and account security improves significantly. Verified users can enjoy uninterrupted gaming without facing restrictions.

KYC also helps resolve account-related issues quickly because your identity is already verified. It builds trust between users and the platform and ensures transparency in all transactions.

Overall, completing KYC improves your gaming experience by making it safer, more reliable, and more convenient.

Conclusion

The 99 Exchange KYC Verification: Complete Verification Guide is an essential step for anyone who wants a secure and smooth iGaming experience. KYC is not just a requirement; it is a safety measure that ensures trust, transparency, and legal compliance.

By following the step-by-step process, uploading valid documents, and avoiding common mistakes, users can complete their KYC quickly and without stress. Once verified, you can enjoy full access to all features, faster withdrawals, and a secure gaming environment.

FAQ – 99 Exchange KYC Verification

1. What is 99 Exchange KYC Verification?

99 Exchange KYC Verification is an identity verification process used to confirm a user’s personal details such as name, address, and identity proof. It helps ensure a safe, secure, and legally compliant iGaming environment.

2. Is KYC mandatory on 99 Exchange?

Yes, KYC is mandatory on 99 Exchange. Users must complete verification to withdraw funds and access all platform features without restrictions.

3. How long does 99 Exchange KYC verification take?

The KYC verification process usually takes between 24 to 48 hours. The time may vary depending on the accuracy and clarity of the documents submitted.

4. Which documents are required for KYC verification?

Users need valid identity and address proof documents such as Aadhaar Card, PAN Card, Passport, Voter ID, utility bills, or bank statements. In some cases, bank verification documents may also be required.

5. Can I use 99 Exchange without completing KYC?

You may be able to register and play games, but withdrawals will not be allowed until KYC verification is completed.